“No risk, no reward.” That phrase has been applied to everything from play calling in sports to starting a business to investing in real estate. It suggests that if risk is not taken then there will be no reward. That may be true but it does not mean that we have to sit back and accept the risk. When it comes to investing in real estate there are things that can be done to limit exposure to risk and thereby improve chances for an even better reward.

Limit the risk from tenants. Where the property is located and what condition it is in will affect what kind of tenants will be interested in living there. Buy a house that is in a thriving neighborhood, in a good school district and doesn’t look like it has had a hard life for the last 20 years. Before renting to tenants run a credit and background check on them, remembering of course, what the law says about what can and can’t be considered when accepting or denying a tenant. Collect deposits and rent in cash or verifiable funds before allowing them to move in. Letting a tenant move in without the necessary funds can be worse than leaving the house vacant.

Limit the risk that it will require too much of your time. The more time you spend dealing with tenants or making repairs the less time you will have to make money whether it is finding the next real estate deal or keeping your boss happy at work. Hiring a good property manager means someone else will be there to answer tenant phone calls, collect rent, schedule repairs and check on your property.

Limit the risk of costly repairs. Find out as much about the property as possible so that you don’t end up buying something that will drain all of your resources. Buy a home that is less than 50 years old as they are less likely to have structural problems that could cost tens of thousands of dollars to fix. Get a professional inspection of the property before the purchase is final and if there are any questions about any of the systems, such as the furnace, hire a specialist to inspect that. If the problems are more than you are willing to deal with then move on to the next property.

Limit the risk that the property won’t support itself . Research other rentals similar to the rental being purchased to know what the property will realistically rent for. Run the numbers then run them again. If the property won’t at least break even then you should probably keep looking for one that will.

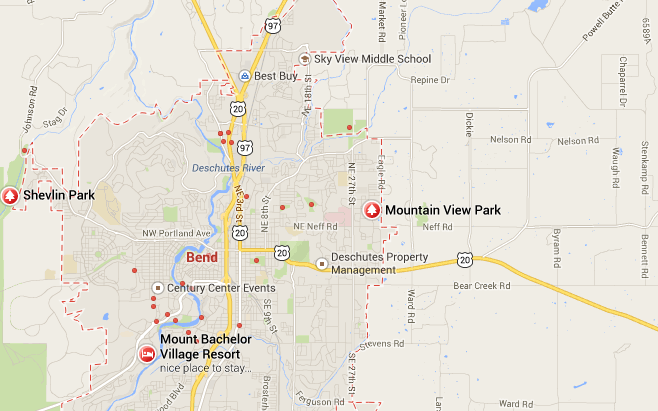

Limit the risk of long vacancies. Buy investment properties in parts of town where people want to live, keep the property in good condition and start advertising as soon as you know the tenants will be moving out.

Limit the risk of losing value. Keep an eye on your investment. Despite all the things they told you about how well they are going to care for your home, your tenants don’t have as much at stake as you do. Drive by the property frequently and inspect the interior of the home at least annually. Protect yourself from real estate market down turn by buying a property for less than market value.

Limit the risk of not being able to sell the property. Real estate is not a liquid investment which means you shouldn’t expect to be able to sell your rental property at the drop of a hat. However, there are some things that can be done to help it sell as quickly as possible. Buying a house in a good neighborhood, close to employment opportunities, in a good school district. The real goal is to buy a house that when it comes time to sell will appeal to the most potential buyers. Not just investors.

Limit the risk of hiring a bad property manager. This also applies to you, the investor/owner as property manager. For those investors wanting to manage their own properties here are some great questions to ask yourself. Should I hire a property manager? If actively managing your rental isn’t for you then here are 8 tips for hiring the best property manager.