Buyer beware! We have all heard that phrase so many times that it has become second nature to be wary of someone selling something. It is good advice for sure but home buyers should also beware of ways they can sabotage their purchase of a house. It is easier than one might think as some overzealous home buyers recently reminded us.

Buyer beware! We have all heard that phrase so many times that it has become second nature to be wary of someone selling something. It is good advice for sure but home buyers should also beware of ways they can sabotage their purchase of a house. It is easier than one might think as some overzealous home buyers recently reminded us.

Problem: The home being purchased is a rental with tenants in place. That means 24 hour notice is required to gain access to the home. Within a week of the deal being in contract the buyers were making life difficult for the tenants, dropping by unannounced and expecting to be given access to the home without a 24 hour notice on more than one occasion. These unannounced visits quickly turned the tenants and to a lesser extent, the seller, against the buyers.

Buyer beware: When tenants are renting a home 24 hour notice of intent to enter the home is required. There is no getting around it unless the tenants say otherwise. In our experience, tenants are seldom willing to waive the 24 hour notice when the house they are renting is being sold and will require that they move. A wise move for buyers in this situation is to make every effort to work with the tenants. Angry tenants can make a transaction much more difficult than it needs to be.

Problem: There are nice, new flower beds in the back yard that the buyers really liked. The buyers told the tenants that they had to leave those planter boxes in the back yard when they moved out. The contract clearly states that tenants’ personal property is not included in the transaction.

Buyer beware: Before writing an offer, buyers should be sure they understand what belongs to the tenants and what is being sold with the house. The first place to look is on the MLS listing. However, just because it says the refrigerator is included, buyers should not assume the sellers won’t change their minds. Buyers should clearly state in their offer what personal property they do or do not want included in the purchase.

Problem: The buyers began advertising the home for rent before the deal had closed. This created more tension between all parties and the tenants because suddenly people interested in renting the house were stopping by and asking to see the inside.

Buyer beware: If you don’t own the house, meaning you and the seller have not signed the closing documents at the title company, don’t advertise it for rent. The rental market in Bend is on fire right now and there is no reason to press your luck with the seller and the legal system by advertising a house you don’t own. The sellers and their tenants are not obligated to allow you to show the home to prospective tenants before closing and in most cases they will not allow it. Prospective tenants will likely think you are trying to con them and will move on to other rentals.

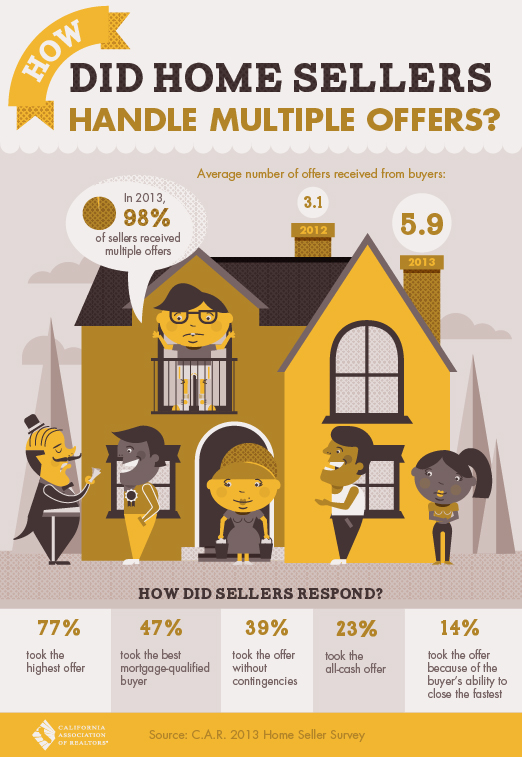

Problem: The buyers appear to have misrepresented their borrowing qualifications to the seller. The lender pre-qualification letter submitted with the buyers’ offer clearly stated that they intend to occupy the home as their primary residence and put 5% of the purchase price as a down payment. The ad mentioned above suggests an intent to actually rent the house out.

This could create two additional problems for the buyer. First of all, the seller, having seen the ad on CraigsList, can terminate the contract to sell AND keep the buyers’ earnest money. On top of that, if the lender sees the ad before closing they can cancel the mortgage and tell the buyers to take a hike. If the lender sees the ad after closing they can call the mortgage due and leave the buyers struggling to find financing. Especially if they don’t have additional cash to make the Loan-to-Value (LTV) at least 75%. We are aware of lenders calling loans due in Bend at least twice recently and it is not a situation anyone wants to find themselves in.

Buyer beware: Be up front with your lender. Don’t try to hide your intentions. The housing problems of 2007 and 2008 forced many lenders to re-evaluate their processes and one change many of them made was to be more vigilant in watching for borrowers who were trying to “game” the system.

Home buyers, it is good to do your homework and be involved in the transaction but if you get too excited about the purchase you could find yourself back at square one. Let the mistakes made by the buyers above be a reminder to beware of sabotaging your own real estate transaction.