For most of the last year in Bend, Oregon the real estate market has favored sellers because the number of homes for sale has been so low. This is called a seller’s market and in a seller’s market good homes often receive multiple offers within a short time after being listed. Multiple offers are great for the seller but put buyers in a predicament of trying to figure out how to make their offer more attractive than all the others.

For most of the last year in Bend, Oregon the real estate market has favored sellers because the number of homes for sale has been so low. This is called a seller’s market and in a seller’s market good homes often receive multiple offers within a short time after being listed. Multiple offers are great for the seller but put buyers in a predicament of trying to figure out how to make their offer more attractive than all the others.

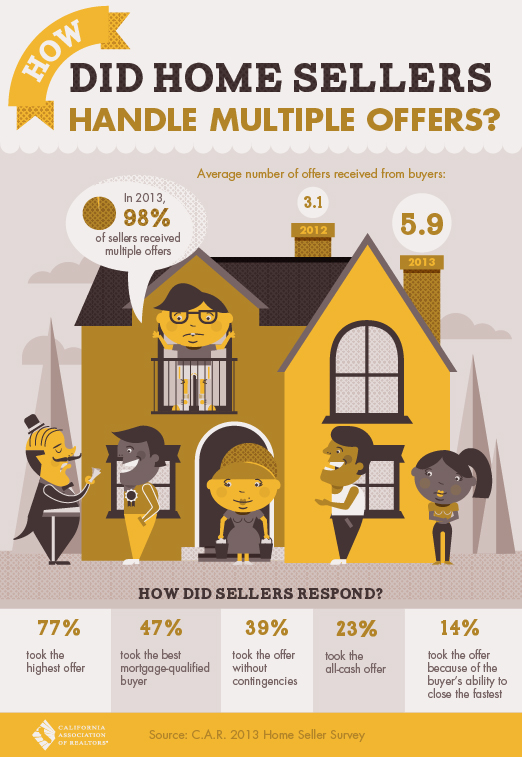

A survey by the California Association of Realtors (see infographic below) confirms what you might already expect. The offer that was the highest priced was more compelling to home sellers than any other factor in 2013. It is easy to see why price would be most attractive to sellers but the good news is there are other factors that can convince a buyer to take a slightly lower price than the highest offer.

One of those factors is how well qualified a buyer is to borrow the money needed to buy the house. Pre-qualification letters are a dime a dozen but submitting an offer with a pre-approval letter can make big difference to a seller and listing agent who know the difference. A pre-qualification is based on what a borrower tells the loan officer. Generally, there is no checking of facts or even a credit check. A buyer who is pre-approved has provided their lender with a complete loan application and usually some supporting documents, credit has been checked, and the lender has run the application through the desktop underwriting system.

Another way to sweeten an offer for a seller is limit or even waive any contingencies. Contingencies are most often used by buyers to protect themselves from things that might be wrong with their borrowing ability or the house. The most common contingencies buyers place in a purchase contract include the inspection, financing and appraisal. A cash buyer can waive the financing and appraisal contingencies but a borrower who needs a mortgage cannot.

Waiving the inspection contingency can be dangerous and is not recommended for buyers who are using all of their cash to purchase the home. If the buyer finds something wrong with the house after the offer has been accepted then it’s “tough luck.” The seller has no obligation to negotiate repairs or price and the buyer has little choice but to proceed with the purchase.

The ability to close the fastest is a factor that buyers will consider in determining who wins a multiple offer situation but it doesn’t carry a whole lot of weight according to the survey. It is likely that most sellers just expect the process to take a certain amount of time so they have already accepted that fact. It probably shows up on the survey because many of the sellers were presented offers from more than one cash buyer. Cash buyers have some flexibility when it comes to how fast they can close but buyers who are borrowing money to buy a home are at the mercy of their lender.

We find it at least a little intriguing that personal information from the buyer, like a letter and family photo didn’t show up in the survey results. Here at Preferred Residential we have seen a “buyer bio” positively influence the decision of some sellers. Many sellers want to see their home go to a buyer they can relate to and some times a letter can tip the scales when two offers are substantially similar.

The bottom line for home buyers in a multiple offer situation is to make your best offer your first one.